Businesses, both large and small, face a number of risks. Risks are an inevitable part of doing business. The uncertainties in your business can be changed daily depending on your business. You should identify the pressing risks your business may face. To identify the risks in your business and equip it with risk management strategies, it is important to conduct a risk assessment round in your business. So, here is a step-by-step guide for small and medium businesses to assess the risks in your business.

Identify the Risks

A risk can be internal (risks inside of your operations) and external (outside of your business). Internal risks are only specific to your business and easier to control than external risks such as:

– Financial risks

– Marketing risks

– Operational risks

– Workforce risks

External risks are usually out of your control such as:

– Changes in the economy

– New competitors

– Natural disasters

– Government regulations

– Consumer demand changes

Once you identify the types of risks that your business is financially exposed to, segregate the risks as external and internal risks so that you are aware of the risks that you can control and the ones that you can’t. You can even identify your financial risks by hiring the right accounting service provider for small and medium-sized businesses.

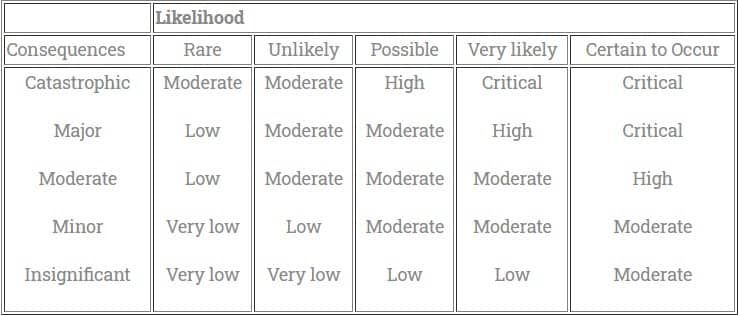

Assess the Risks

When you list down the types of risk that your business is exposed to, you need to determine the severity of the uncertainty in the financial aspect. Create a risk rating matrix to identify the risks that can cause severe damage to your business finances and the practical measures to manage the financial risk. Then, create a table as given below:

Risk rating level needed

– Critical – Immediate action is required

– High – Action needed quickly (within 1-2 days)

– Moderate – Action required with a week

– Low – Required action with a reasonable period (2-4 weeks)

– Very low – Risk can be eliminated or lowered easily with time

Control the Risks

Once you rate the risk in your risk rating matrix, you need to understand the various risk control measures that can help you control or eliminate the risk. Risk control is a set of methods by which firms evaluate potential losses and take action to reduce or eliminate the risks.

Figure out controls by looking at the patterns over time, assessing their impacts, and also the likelihood of occurring again. Here are some of the risk control techniques:

Eliminate it – You can avoid the risk by eliminating the core problem. For instance, if you discover certain chemicals used in your manufacturing company are dangerous for your employee’s health, as the owner, you substitute the chemical with a safe alternative to protect your workers’ health.

Prevent it – When there is a risk, you might try to minimize the risk if eliminating costs you a lot. For instance, if you have something in your inventory that is susceptible to theft, you can include patrolling security guards in your security plan, install video cameras or use advanced storage facilities.

Reduce it – Some risks can’t be avoided, but you can always limit the losses when the threat occurs. For instance, if your company stores hazardous or flammable materials in a warehouse, you might install water sprinklers to reduce the damage when there is a fire threat. You may also use insurance as a risk control measure to protect the things that are susceptible to catching fire.

Transfer it – If your business deals with multiple lines of business offering such as a variety of products and services, try to analyze the risks differently. Consult a professional financing firm offering all types of accounting services.

Test Your Risk Control Measures

Once you have decided on the risk control measures for the respective risk that you have listed, you need to test the effectiveness of your risk management approach and controls. When you execute your risk control measure strategies, you can determine the best strategy to control that particular risk. Not every risk technique will be the silver bullet to protect your business from the potential risk. As we have mentioned, risks in business change every day, and therefore, you need to find a solution that is flexible and effective enough even when the risks change. You can always depend on the financial accounting service provider to help you tackle the right risk control measures for your business.

Monitor and Review

When you find the right risk control strategy, you need to monitor the performance of your risk control measures periodically. Regular evaluations of the risk by an experienced accounting service provider like ATS Accounting & Tax Edmonton will help you determine:

– What does management think of the risk controls?

– What does your financial team think about the controls?

– Is a particular risk control measure still relevant?

– Did the nature of the financial risk change?

– Are the controls still in place and active as planned?

Prioritize the risks that need your attention and effort. You can quickly assess the risks or control them in several ways such as:

– Consult your team involved with the control measures

– Consult your management who administer the controls

– Check the performance reports regularly with the accounting service provider

– Physically check the conditions of the controls

It is essential for your team to know about the control measures and the purpose of implementing specific risk control measures. When you and your team are on the same page, your company can successfully reduce or eliminate the risk more effectively.

Risk assessment is a living process, and when it comes to assessing financial risk, you need to seek assistance from trusted financial and accounting advisors like ATS Accounting & Tax Edmonton. So keep track of your business debts, incomes, expenses, and maintain financial statements and assess the risk accordingly. We provide all-in-one Accounting Solutions to 400+ Companies and specialize in providing comprehensive accounting services to a wide range of industries. Request a Free 15-minute consultation with one of our financial advisors today!